In this example we used 15 minute bars for the Swiss Franc/US dollar currency pair. We instructed ChaosHunter to trade long and short only between the hours of 5:30 am and 11:30 am eastern time and exit any position after 11:30 am. (Time flags are useful if you want your ChaosHunter model to trade more often because of the forced exit.)

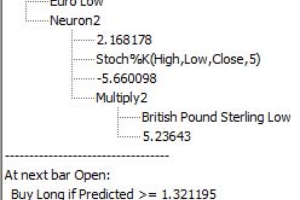

We selected Stoch%K, Euro high and low, and the British Pound high and low as inputs to the model and the Swiss Franc open as the output. On the optimization tab we chose Evolution Strategy, a population size of 300 and a buy/sell threshold range of +/- 10. We traded an account size of $100,000; costs were assumed to be $10 each way.

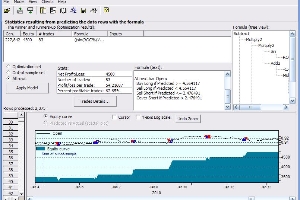

What is shown are results for the first few days from the "out-of-sample" time period, which is the period in time just after the optimization took place. In other words, the system did not "see" this data when the model was being built; the backtest simulates trading that would have occurred had you built the model earlier and then traded it during the dates shown on the chart. (Note that many intraday models work better if they are re-evolved as often as weekly with more recent data.) You can download the data, template, and model files from www.ward.net if you own ChaosHunter.

The trading formula found by ChaosHunter is below:

ChaosHunter builds great FX models too. The daily model shown of USD/JPY (using eSignal data) was built on daily data starting January 2006 through December 17, 2008 and then inserted into NeuroShell Trader for trading after that. (Of course your models can be inserted into many trading platforms, not just NeuroShell. However daily models probably need no trading platform at all since ChaosHunter can load and execute daily data each day). The equity curve shown is the growth in Yen of $1 after the model was built. The model included chaotic components. No carry, spreads, commissions, or any other costs were included in this model.

Example 3 was built the same way Example 2 was built, except that we used Gold.

In this example we used one Australian Dollar CME Futures contract and 15 minute bars. We instructed ChaosHunter to trade long and short only between 9 and 11 am, and exit any position after 11 am. The only variable we utilized was volume, to which we allowed ChaosHunter to apply several of its included indicators. Costs were assumed to be $10 each way. What is shown are results for the first week after the model was finished, so the model held up well. (Many intraday models work better if they are re-evolved as often as weekly with more recent data.)

Disclaimers:

Any models might not provide good results very much longer than shown, so there is no guarantee that a model that performed well "out-of-sample" will not lose money later. It happens. All trading involves risk, including the potential for loss of principal. Furthermore, the same inputs will not necessarily work as well with other ticker symbols and in different time periods. However, the inputs and models are not specific to one type of instrument, meaning that a stock model is just as likely to work for a futures or Forex contract as another stock. Not all of the models we build work this well, and therefore your results may vary as well.