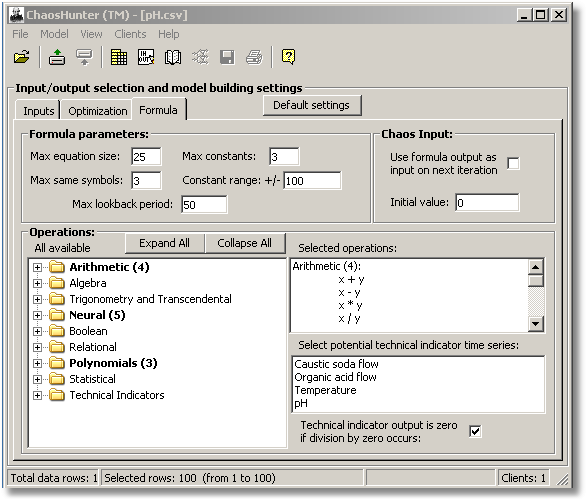

Max Equation Size

The equation size is the max number of operations and operands, including constants, than can be used in the final formula (equation). Setting this is where you may have to use some judgment. If you are convinced the problem can be solved by a short formula, then an equation size of 20 to 25 may be sufficient. Otherwise, a number from 40 to 60 will work better, because the ChaosHunter will actually be working on several formulas at once if it has enough space here. However, larger max equation size can slow down progress, so we rarely recommend a size greater than 120.

Max Same Symbols

Here again some judgment may be necessary. If this parameter is set to 3, then so input can appear in the formula more than three times. Setting the number too large can slow down evolution. In our experiments we have found from 3 to 6 is usually sufficient.

Max Constants

If you feel constants may be important in your model, you should probably use about 10 max constants. The actual number of max constants will be Max Same Symbols times Max Constants. So if Max Same Symbols is 3, and Max Constants is 10, you could see up to 30 constants that take on no more than 10 distinct values. In other words, there could be up to 3 clones of each constant in the formula.

Constant Range

If you use scaling of your inputs and output, constants between plus and minus 5 should work well. If you do not scale at all, select some number in the range of what the output variable might be. Different constant ranges may make solve the problem differently.

Max Lookback Period

This parameter is only used if you have opted to use technical indicators, and you have selected the inputs to be used as parameters to those technical indicators. The lookback will be the most likely max distance back in the time series that data can be found to affect the output. For price time series used in trading models, we like 20 to 30. If you are looking for more frequent trades, a smaller number such as 5 may work better.

Note that if the optimizer selects a lookback of x in any technical indicator, the formula cannot calculate until at least row x.

Chaos Input

Most definitions of chaotic functions provide for an input which is the last value the formula produced. Turn this option on if you have a time series where you believe that new outputs are affected by previous one, or that you are indeed dealing with chaos. We feel that price time series are almost always so affected. We have no guidance for the initial value except to say that it might be of experimental value.

For the current row of data, the program uses a value computed by the formula on a previous row of data. On the very first row (row #1) the chaos variable is set to an initial value (0 by default). The formula outcome on row #1 is calculated using input data from row #1 and the initial value (0) for the chaos variable. On the second row (row #2) the formula uses inputs from row #2 and the calculated formula value from row #1 for the chaos variable, and so on. Note that it can take quite a few rows of data before the ChaosVar takes on meaningful values (it is not possible to determine how many rows are needed for any particular case or even in general, but we guess at least 10 to 50). So with that in mind, here are the considerations:

1. Out-of-sample testing

If you look at an out-of-sample test, the ChaosVar starts with its initial value. That means it can take quite a few rows of data until the formula is really "up to speed" with respect to the Chaosvar. Out-of sample testing is really most accurate if the formula has had previous rows to include in the calculation of ChaosVar. So when used for trading, as an example, trading signals will be more accurate if the out-of-sample set is not evaluated by itself.

2. Inserting the formula into a trading chart

When you insert a formula containing the ChaosVar into a trading chart, the trading signals will be most accurate if there are a number of previous bars in the chart prior to the start of actual trading.

3. Repetition of results

If you attempt to compare the signals in your trading platform chart with the signals ChaosHunter showed, you will not be comparing "apples to apples" if the ChaosVar is in the formula unless both the ChaosHunter and the trading start on exactly the same bar.

4. Access on trading platforms

In order to insert a formula using ChaosVar into a chart, your trading platform must be capable of accessing the last value of the formula within the formula itself. (NeuroShell Trader Professional, for example, is not capable of that). If your platform is not capable you will have to either generate formulas without ChaosVar or insert your formula by calling the ChaosHunter Runtime server (as NeuroShell Trader Professional does).

Technical Indicator Output

Click here for details on how to use the ChaosHunter Technical Indicators.